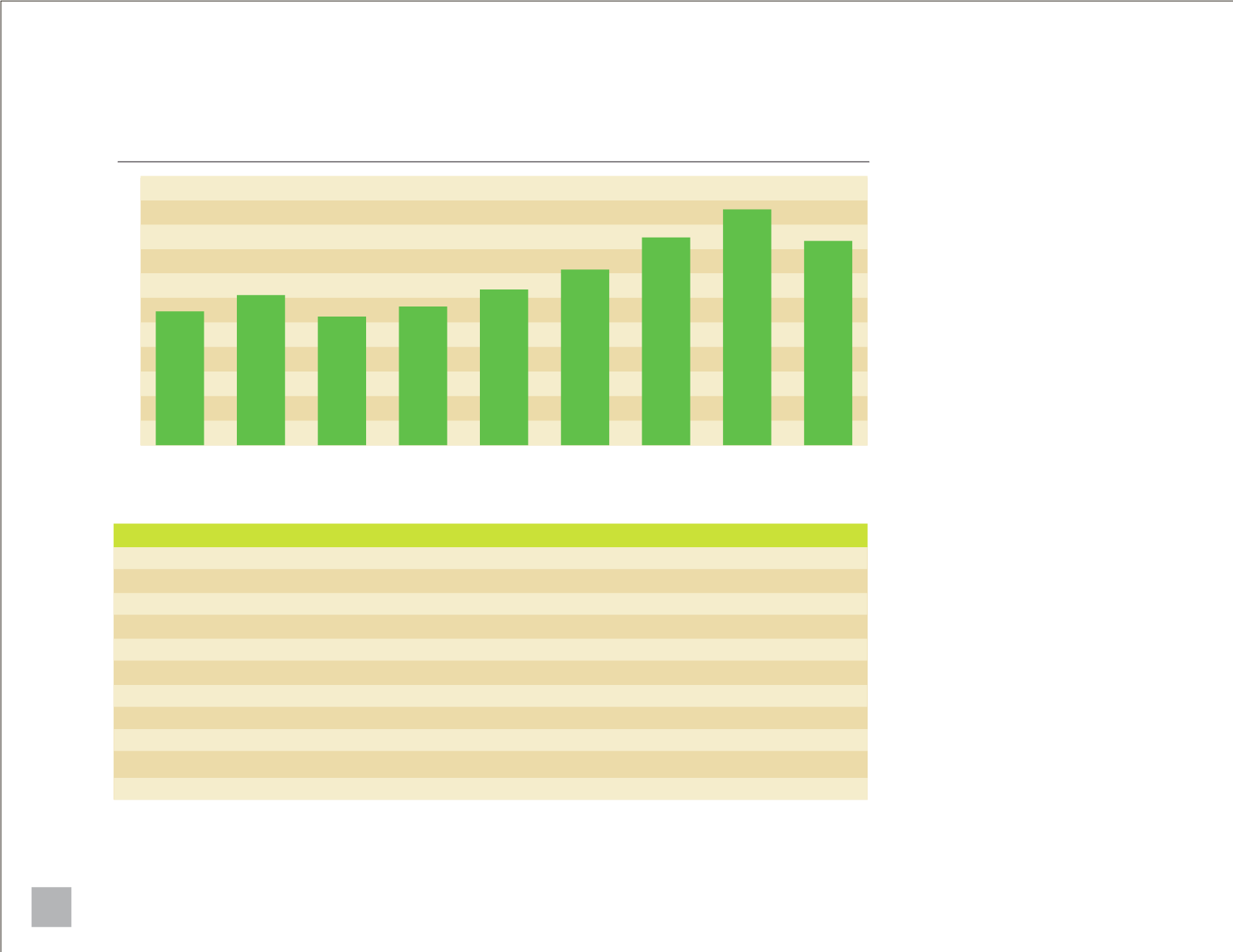

*Other sources

includes refunds,

reimbursements,

agency& trust

fund revenue, bond

proceeds, transfers

andadvances

Source

Income taxes

Charges for services

Servicepayments

Licenses, nes andpermits

Property taxes

Intergovernmental revenues

Hotel/Motel taxes

Miscellaneous

Local, stateand federal grants

Interest income

Special assessments

Total

Other Sources*

GrandTotal

Percentof total

70.4%

9.7%

6.7%

3.1%

2.8%

2.6%

1.6%

1.5%

0.8%

0.6%

0.2%

Amount

$88,068,530

$12,191,762

$8,325,495

$3,823,203

$3,466,600

$3,247,951

$2,005,534

$1,848,756

$1,036,909

$774,216

$238,990

$125,027,946

$85,204,749

$210,232,695

19

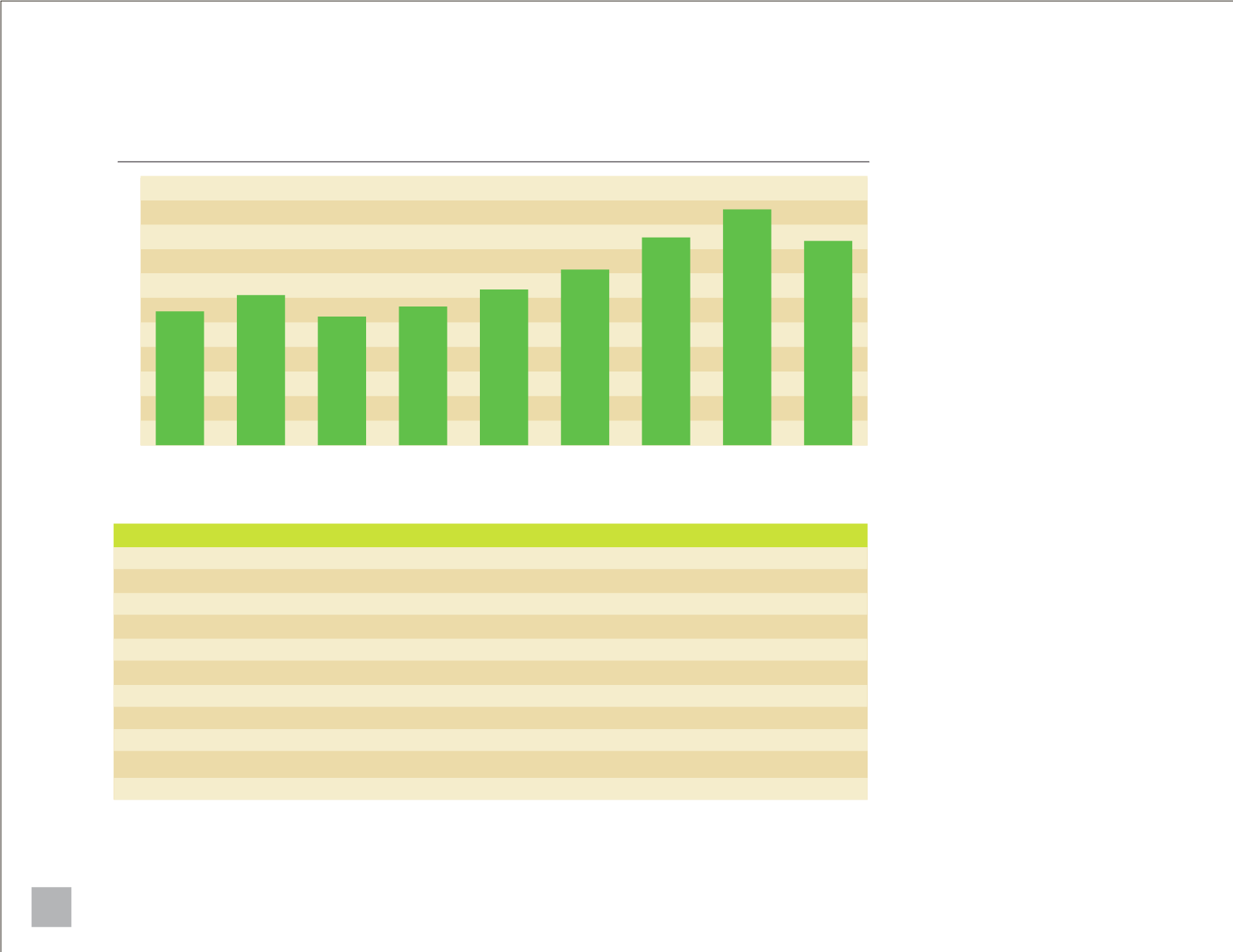

2007

2008

2009

2010

2011

2012

2014

2013

2015est.

$40

$45

$50

$55

$60

$65

$70

$75

$80

$85

$90

Thegrowth in theCity’s economicactivity is

re ected inDublin’s income tax revenue. In

2014, income tax revenue totalednearly$88.1

million, an increaseof 7.3%over 2013.

TheGeneral Fund receives 75%of all income

tax revenue,while the remaining25% is

allocated to theCapital ImprovementsTax

Fund.

Approximately79%of theCity’s income tax

revenue - $69.2million -wasgeneratedby

payrollwithholdings from individualsworking

within theCity’s corporate limits.

Dublin’s continuedeconomicvitality is the

result of qualitydevelopment, strategic

planning, and theCity’s continuede orts to

attract and retainhigh-qualitycommercial

development.

BuildingOur Financial Future

FinancialReport

IncomeTax

|

inmillions

MajorRevenueSources

| 2014