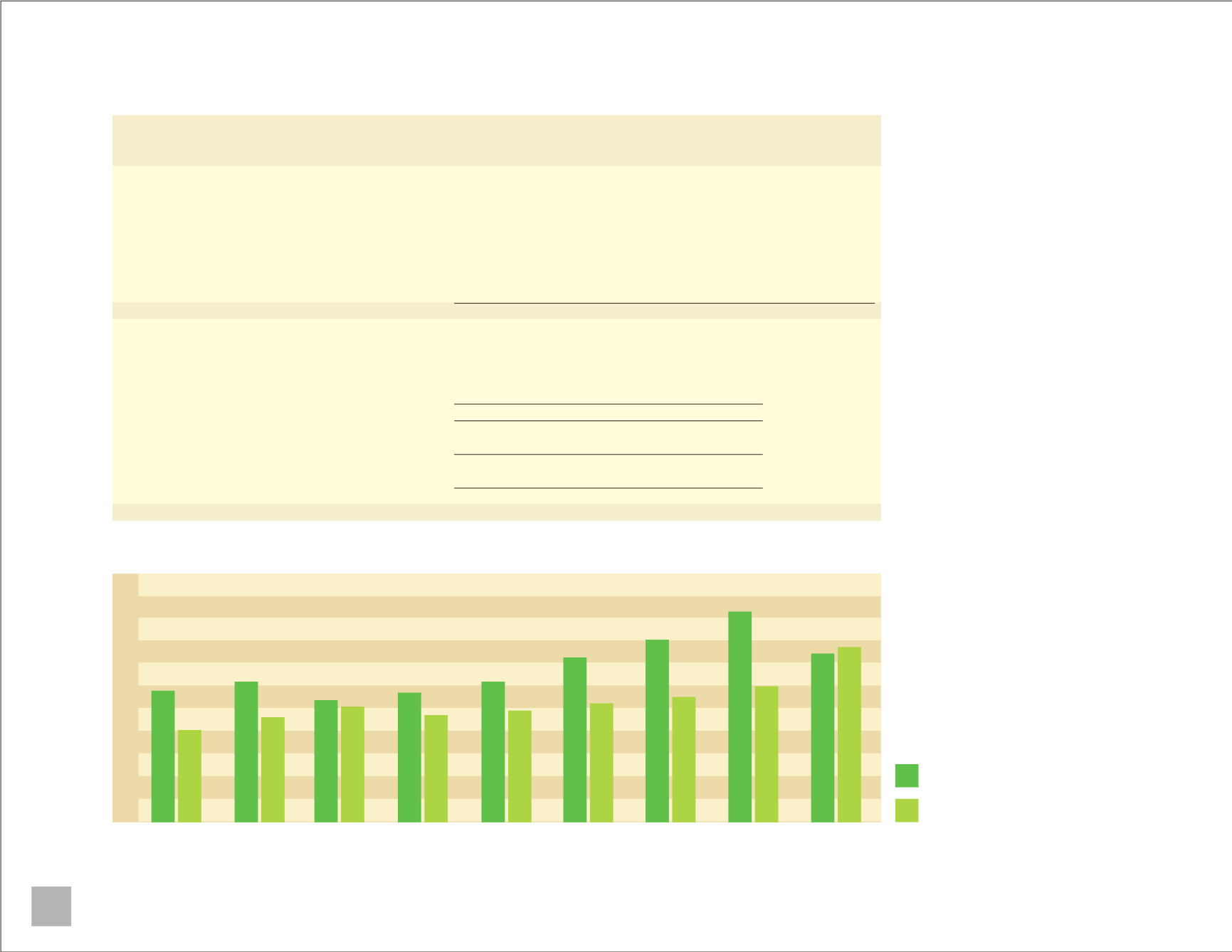

TheCity’s strong taxbaseandconservative

budget philosophyhave resulted in

operating revenues exceedingoperating

expenditures formanyyears. Thishas

allowed theCity to increasecapital

programmingand takeadvantageof

opportunities as theyarise. Proactive

measures implemented thepast fewyears,

includingevaluatingalternativeapproaches

for servicedelivery, closelyevaluating

themeritsof personnel vacancies and

continuing tomonitor expenses, have

allowed theCity’s nancial position to

remain strong.

BuildingOur Financial Futurecon’t.

21

Revenues

Expenditures

2007

2008

2009

2010

2011

2012

2014

2013

2015est.

$40

$45

$50

$55

$60

$65

$70

$75

$80

$85

$90

Revised

Variance

Percent

Budget

Actual

fromBudget

ofTotal

BeginningBalance

$56,038,803

$56,038,803

$ -

Revenues:

Income taxes

57,356,250

66,051,400

8,695,150

91.1%

Licenses, nes andpermits

1,861,300

3,187,559

1,326,259

4.4%

Intergovernmental revenues

548,710

690,404

141,694

1.9%

Charges for services

961,450

1,534,078

572,628

2.1%

Interest income

325,000

359,763

34,763

0.5%

Miscellaneous

188,000

668,153

480,153

0.9%

Total Revenues

61,240,710

72,491,357

11,250,647

100.0%

OtherSources:

Refunds and reimbursements

50,000

299,418

249,418

Transfers

-

-

-

Advances (1)

-

3,085,000

3,085,000

TotalOther Sources

50,000

3,384,418

3,334,418

Total Revenues andOther Sources

61,290,710

75,875,775

14,585,065

Advances tobeRepaid (2)

21,683,347

21,683,347

-

Total ResourcesAvailable forExpenditure

139,012,860

153,597,925

14,585,065

OperatingRevenuevs.OperatingExpenditures

|

operating budget - inmillions

(1) Advances are

not required tobe

budgeted.

(2) Advanceswill be

repaidover aperiod

of years, as service

payments fromTax

Increment Financing

Districts are received

General FundRevenuesBySource