- About

- Residents

- New Residents

- Neighborhood Resources

- Request a Service – GoDublin

- Permits

- Code Compliance

- Community Noise

- Community Events

- Community Resources

- Envision Dublin Community Plan

- Facility Rentals

- Historic Dublin

- Parks & Recreation

- Safety

- Speed Management

- Veterans

- Volunteer Service Opportunities

- Voting & Elections

- Visitors

- Services

- Business

- Development

- Government

- Careers

- News

- About

- Residents

- New Residents

- Neighborhood Resources

- Request a Service – GoDublin

- Permits

- Code Compliance

- Community Noise

- Community Events

- Community Resources

- Envision Dublin Community Plan

- Facility Rentals

- Historic Dublin

- Parks & Recreation

- Safety

- Speed Management

- Veterans

- Volunteer Service Opportunities

- Voting & Elections

- Visitors

- Services

- Business

- Development

- Government

- Careers

- News

Taxation

Due Date for Tax Year 2025 Annual Returns

Individual Taxpayers

Wednesday, April 15, 2026, is the due date for the 2025 Dublin Individual tax return filing, payment and the first quarter estimated payment for tax year 2026.

Municipal Net Profit Taxpayers

Wednesday, April 15, 2026, is the due date for the 2025 Dublin Business return filing, payment and first quarter estimated payment for tax year 2026.

Click here to be directed to the Dublin Division of Taxation’s E-file/E-pay landing page and choose the appropriate filing option.

Non-Residents Requesting a Refund

Non-residents can now submit refund requests electronically; however, you will still receive a paper check for the approved refund amount. Click here to be directed to the Dublin Division of Taxation’s E-file/E-pay to create an account and file your return.

- All refunds are processed in the order of receipt. Per Ohio Revised Code and Dublin City Code we have ninety (90) days from the date the complete return was filed or the date it was DUE, whichever is later to process and pay refunds.

- Please note, in accordance with ORC 718.13, any refund issued by the City of Dublin will be disclosed to your taxing jurisdiction of residency.

Net operating loss carry-forwards

Beginning in tax year 2023, Net operating loss carry-forwards are permitted at 100% of the current year’s income. You must include a worksheet showing any net operating loss claimed on previous year(s) returns.

Visiting the Tax Office

Our office is located inside the Dublin City Hall building at 5555 Perimeter Drive, Dublin, Ohio 43017. The receptionist at the front desk will direct you to the Taxation office. We will then assist you at our Taxation front window or conference room.

For your convenience, you can also use our secure drive-up mailbox, located at the front of Dublin City Hall, to drop off your tax returns, documents and non-cash payments.

If you have any questions, please call us at 614.410.4460 (Monday – Friday 8 a.m.-4:30 p.m.) or e-mail at taxinfo@dublin.oh.us. Walk-ins are always welcome during business hours.

Online Payment Option Available to Pay Your Dublin Taxes

Individuals, Businesses and Employers can pay electronically using a checking or savings account (no fee) to pay tax due with your tax return filing, make estimated payments or pay other balances due.

Additionally, tax payments can be made using Visa and MasterCard credit cards and debit cards, as well as Google Pay. Please note, there is currently a 3.0% fee charged on these payment types by the payment processing company, with a minimum fee of $1.95.

Payments may take two (2) business days to post to your bank account, however, our office will be able to view the payment immediately and will post it to your tax account the next business day.

Click here to be directed to the Dublin Division of Taxation’s E-file/E-pay landing page and choose the appropriate filing option.

Hotel/Motel Tax

The City of Dublin Hotel/Motel Tax Fund was established to improve the quality of life for our residents, corporate citizens, and visitors. Home to 19 hotels/motels, Dublin generates funds from a six-percent tax on overnight stays. These funds are invested back into the community through designated projects and events that enhance visitor appeal and encourage overnight stays. Questions? Please contact Dublin Finance Department – Michelle Green at 614.440.4436

About Tax Filing in Dublin

All residents of Dublin (that are 18 and older) are required to file an income tax return with the City, regardless of where their income is earned. The local income tax rate is 2.0% and applies to gross wages, salaries, compensation, and net profits of businesses and rentals. The City of Dublin provides 100% credit up to 2.0% for taxes withheld or paid to the workplace municipality for individuals.

All businesses located in Dublin or those conducting business within the City are required to file an annual net profit return. All employers with employees working within the City of Dublin (including from their home) are required to withhold the tax of 2.0% and remit these withheld taxes to the Dublin Division of Taxation.

The revenue generated from income tax funds the majority of City-provided services and capital improvement projects. Income tax revenue is allocated 75% to the General Fund and 25% to the Capital Improvements Tax Fund. The income tax revenue allocated to the Capital Improvements Fund may only be used for capital improvements.

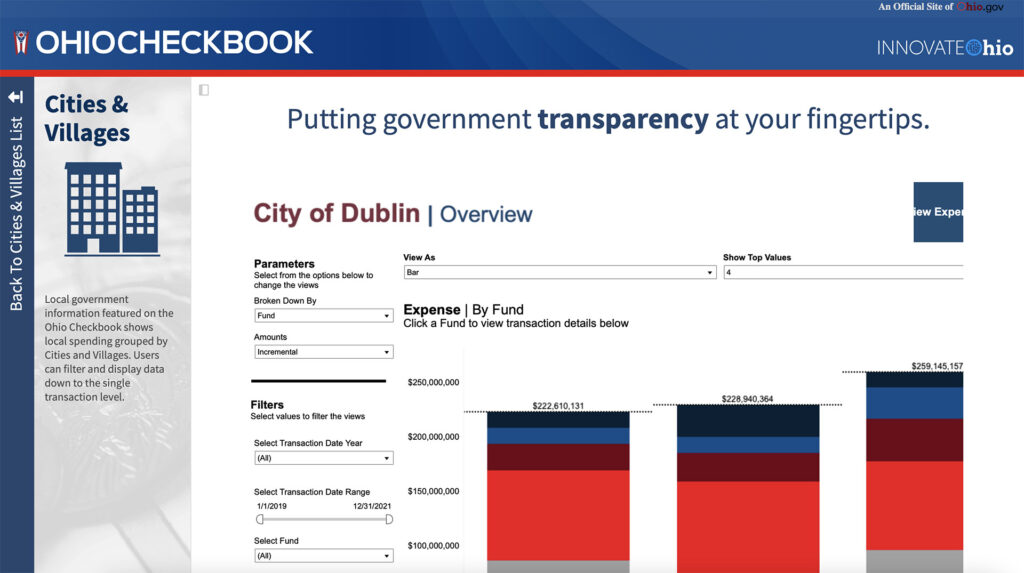

Financial Transparency

- Resident Individuals

- Nonresident Individuals (see below)

- Associations (including Partnerships, Joint Ventures, etc.)

- Corporations (including S-Corporations)

- Fiduciaries – Estates and Trusts (including Grantor Trusts)

Individuals

The following persons must file an Annual Return:

A RESIDENT of Dublin having earned income and/or who engages in a business or profession in or outside their place of residence—even if all taxes have been properly withheld. A Declaration of Estimated Tax is required for all individuals whose tax is not fully withheld or with business income if the estimated tax due is more than $200.00.

Residents who are exempt from paying the tax (e.g. pension income or under age 18) must complete a Declaration of Exemption form and submit it to our office in order to inactivate your account.

Not sure if you are resident? Check your status here.

A NONRESIDENT of Dublin having earned income in Dublin from which Dublin city income tax has not been fully withheld by your employer, and/or who engages in a business or profession in Dublin. Any taxpayer engaged in business within Dublin must file an annual return, even if a loss is claimed on the business. A declaration of estimated city income tax is required for all individuals whose estimated tax due is more than $200.00.

Nonresident Individual taxpayers seeking a refund for taxes withheld should complete a Nonresident Individual Return form.

INDIVIDUALS – Ask yourself these questions:

- Was I over 18 and a resident of the City of Dublin for any portion of the tax year?

- Did I have any other earnings in Dublin from which at least 2.0% was not withheld?

Self-employment income, net income from rentals, tips, commissions, etc. are taxable to the City as earned income. If you have rental property in Dublin or other business income earned within Dublin, you must file a return even if you show a loss.

If you answered “yes” to either of these questions, you are required to file a Dublin income tax return. Forms and instructions are available on our web site www.dublinohiousa.gov/taxation/ or you may call the Division of Taxation at 614.410.4460.

Businesses

The following business enterprises must file an Annual Return:

ASSOCIATIONS, CORPORATIONS, and FIDUCIARIES (ESTATES and TRUSTS) deriving income or losses from work done, services performed or rendered, and/or business conducted in Dublin.

All taxpayers engaged in business must file an annual return, even if a loss is claimed on the business. A declaration of estimated city income tax is required for all business entities with estimated tax due of $200.00 or more.

Did You Know That:

- The City of Dublin Division of Taxation provides taxpayer assistance regarding income tax matters between 8 a.m. and 5 p.m. Monday through Friday.

- Your mailing address (i.e. post office or school district) does not always reflect the taxing jurisdiction in which you live. When in doubt, find out by clicking here or call 614.410.4460.

- As a Dublin resident, you are responsible for paying additional tax if the tax rate where you work is less than 2.0%.

- Social Security benefits, pension income, welfare payments, state unemployment, workers’ compensation, interest, and dividends are not subject to Dublin city tax.

- The filing deadline for calendar year taxpayers is April 15, 2024. All extension requests must be submitted on or before this date.

- Extensions are an extension of time to file not an extension of time to pay any tax due. Payment of any estimated tax due should accompany the extension request.

- A copy of the Federal extension (Form 4768 – Individuals and Form 7004 – Corporations, Partnerships, & Trusts) is acceptable, but must be submitted to Dublin by the original due date of the return.

In accordance with Ohio Revised Code §718.27, the interest rate that will apply to late tax payments is calculated by adding five percentage points to the federal short-term rate (rounded to the nearest percentage point) that was in effect during the current year(s).

For 2026 the interest rate is 9%

Past interest rates:

- 2017 – 6%

- 2018 – 6%

- 2019 – 7%

- 2020 – 7%

- 2021 – 5%

- 2022 – 5%

- 2023 – 7%

- 2024 – 10%

- 2025 – 10%

Questions should be directed to the Division of Taxation at 614.410.4460.

Dublin Municipal Income Tax Ordinance

- Chapter 35 Effective through December 31, 2015 – for taxable years ending 2015

- Chapter 38 Effective January 1, 2016 – for taxable years beginning 2016

City

Use this link for the contact and basic tax information for all municipalities in Ohio.

School District

School District taxes in the state of Ohio are administered by the Ohio Department of Taxation.

County Auditor & Property Taxes

The Franklin, Union, and Delaware County Auditors’ offices administer and collect property taxes on behalf of the City and should be contacted with any questions regarding property valuations or property taxes.

State of Ohio

Federal

Office Phone Number:

614.410.4460

Fax

614.410.4956

Office Hours:

Monday – Friday

8 a.m. – 4:30 p.m.

Tammy Lehnert, Director of Taxation

Report an Issue

Request a service or report an Issue.

Tell Dublin

Send us your public input.

Dublin, Ohio, USA

5555 Perimeter Drive

Dublin, Ohio, 43017

Mon – Fri: 8 a.m. – 5 p.m.