Filings due April 17, 2018

Electronic Filing/Payment

The City of Dublin encourages all individual taxpayers with an established account to file their annual City Tax Return (Form DIR-38) as well as make any related payment electronically. Electronic filing (E-File) and payment (E-Pay) are available online at dublintax.com

To E-File, taxpayers will need to use the Account Number on the postcard they received in the mail, or use the Account Lookup Link on the E-File page.

Taxpayers can file jointly with the City of Dublin even if they filed separately for the IRS. There is no advantage to filing separately at the municipal level and it would greatly help the City to process returns more expediently and more efficiently.

Requests for Refunds cannot be filed electronically unless the taxpayer is under 18 and has previously filed for a Dublin refund. However, they can electronically file if they are carrying any credit forward to 2018.

Digital copies (PDF, JPG or TIF) of any and all required return forms are accepted, such as: Form W2, 1099 or Federal 1040 and Schedules C, E and F.

E-Pay is a convenient electronic payment option for paying any taxes due. Payment can be made by credit card (Master Card, Visa or Discover Card). Note: The card company charges a convenience fee, currently 2.65% of the total amount remitted.

Recent Changes to Municipal Taxes

For tax year 2017 there are many changes to municipal taxation that have been implemented per the passage of House Bill 5 by the Ohio General Assembly. The major changes to municipal taxes include:

- No remittance of tax is required if the amount shown to be due on the return filed is ten dollars ($10.00) or less. Likewise, refunds of overpayments shall only be issued of overpayments greater than ten dollars ($10.00).

- Taxpayers shall only be required to make estimated payments on a taxpayer’s tax

liability for income earned in Dublin for the current taxable year if the amount payable as estimated taxes is at least two hundred dollars ($200.00) or greater.

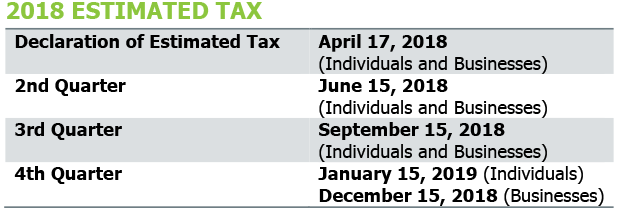

To avoid penalty and interest assessments, a taxpayer required to make estimated payments shall be required to make timely payments equal to ninety percent (90%) of the tax liability for the current tax year or one hundred percent (100%) of the prior year tax liability (safe harbor provision). For individual taxpayers these estimated payments are required to be made by April 17, June 15, September 15 of the current tax year, and January 15 of the following year. For business taxpayers the first three estimated payments are the same, but the 4th estimated payment is due on December 15 of the current tax year.

- The first year that net operating loss carryforwards may be calculated for the City of Dublin is with regard to the taxpayer’s 2017 tax return impacting net profits filed in 2018. The first return on which a net operating loss carryforward may be utilized is the taxpayer’s 2018 tax return filed in 2019. Net operating loss carryforwards prior to tax year 2017 may not be utilized against any other sources of income of the taxpayer.

- Any taxpayer that has duly requested an automatic six-month extension for filing the taxpayer’s federal income tax return shall automatically receive an extension for filing their Dublin return.

- The income or losses from the net profits of a resident taxpayer shall be aggregated together regardless of the taxing jurisdiction in which the activity was conducted. The taxable income amounts to be utilized by taxpayers on the filing of their individual tax returns should be taken from Federal Schedules C, E, and/or F. Any loss from net profits shall not be allowed as a deduction against employee wages. Dublin limits the allowable credit to be taken on the taxpayer’s return to 2.0% of the amount of income subject to the tax. The limiting of the credit to the amount of income subject to tax prevents the crediting or refunding of taxes remitted to any other municipal taxing jurisdiction.

- The income or losses from the net profits of a non-resident taxpayer shall not be reflected on you individual non-resident return for Tax Year 2017 per Ohio Revised Code Section 718.01(B)(1)(d).

- The definition of taxable income shall not include the individual nonresident’s distributive share of the net profit or loss of pass-through entities owned directly or indirectly by the nonresident. Accordingly, no credits or refunds will be granted related to the offsetting of gains and losses from pass-through partnership or limited liability companies incurred within the City of Dublin commencing with tax year 2016.

- The amount of an individual’s employee business expenses reported on form 2106 and deducted for federal income tax purposes for the taxable year is subject to the limitation imposed by section 67 of the Internal Revenue Code. For the municipal corporation in which the taxpayer is a resident, the taxpayer may deduct all such expenses allowed for federal income tax purposes. For a municipal corporation in which the taxpayer is not a resident, the taxpayer may deduct such expenses only to the extent the expenses are related to the taxpayer’s performance of personal services in that nonresident municipal corporation.

- For tax year 2017 individual taxpayers who have a filing requirement for reporting rental real estate activities shall use separate accounting for the purpose of calculating net profit sitused to the municipal corporation in which the property is located. The separate accounting as shown on Federal Schedule E Part I should be utilized for reporting income/loss from rental real estate activities. Any common expenses or shared expenses shall be allocated between the rental properties.

- Twenty Day Rule

An employer is not required to withhold municipal income tax on qualifying wages paid to an employee for the performance of personal services in a municipal corporation that imposes such a tax if the employee performed such services in the municipal corporation on twenty or fewer days in a calendar year, unless one of the following conditions applies:

- The employee’s principal place of work is located in the municipal corporation.

- The employee performed services at one or more presumed worksite locations in the municipal corporation.

- The employee has requested that local tax be withheld due to residency.

- The employee is a professional athlete, professional entertainer, or a public figure earning qualifying wages.

Interest Rates Effective State-wide

Any local tax liability incurred on or after January 1, 2017 shall be subject to an interest rate of 6% state-wide. The interest rate for 2018 will be subject to an interest rate of 6% statewide.

Penalty Rates Effective State-wide

Any local tax liability incurred on or after January 1, 2017 for Individuals, S-Corporations, Partnerships, Limited Liability Companies, and Trusts shall be subject to a penalty rate of 15%. Additionally, the local tax liability incurred on or after January 1, 2017 for Employers shall be subject to a penalty rate of 50% of the tax due.

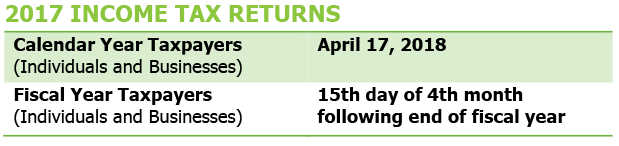

Important Dates

Due dates for filing city tax returns and remitting payments in 2018 are as follows:

Daily Deposit

Each employer who is required under Internal Revenue Code Section 6302 to make next day deposit of tax withheld from employee wages shall then electronically deposit municipal taxes withheld with the City of Dublin, Income Tax Division at the same time.

Download: 2018 Income Tax News Brief

Division of Taxation

City Hall

5200 Emerald Parkway

Dublin, OH 43017

Phone: 1.888.490.8154

Fax: 614.923.5520

Monday-Friday: 8 am – 5 pm