Income Tax Revenues

In the 2017 Operating Budget, Staff projected $84,734,100 in revenue from the local income tax, with 75% or $63,550,575 programmed in the General Fund, and 25% or $21,183,525 programmed in the Capital Improvements Tax Fund. This estimate was based on a 5.8% decrease over the 2016 actual income tax revenue and took into account the loss of revenue anticipated from Nationwide Insurance and JP Morgan Chase.

As previously reported to City Council, the first quarter ended with income tax revenues decreasing 1.3% over the first quarter 2016. Year-to-date through the second quarter 2017, income tax revenues decreased 2.4% or $1,111,979. Withholding revenue, the largest component of income tax revenue has declined 2.0% while net profits declined 4.2% and revenue from individuals declined 2.7%.

As previously reported to City Council, the first quarter ended with income tax revenues decreasing 1.3% over the first quarter 2016. Year-to-date through the second quarter 2017, income tax revenues decreased 2.4% or $1,111,979. Withholding revenue, the largest component of income tax revenue has declined 2.0% while net profits declined 4.2% and revenue from individuals declined 2.7%.

As previously mentioned, this decline was anticipated with the loss of revenue from Nationwide and Chase. In fact, if the revenue received from those two companies in both 2016 and 2017 were excluded from our receipts, revenue from withholding would reflect a 2.52% increase over 2016, with overall revenue increasing 1.0%. The decline we are experiencing is attributable to the loss of those two employers. More specifically, our top ten employers, excluding Nationwide, experienced a 4.9% increase in the first half of 2017 over the first half of 2016.

The graph below depicts the City’s second quarter income tax revenue each year from 2013 through 2017.

For planning purposes, staff can start to draw more informed conclusions as to projected income tax revenues at year-end based on collections through the first half of 2017. While our income tax revenues have declined as compared to 2016 activity, as expected, our actual revenues through the second quarter reflect a 3.7% increase over the 2017 budgeted amount. The second half of the year is anticipated to bring in new employees from United Healthcare (UHC). However, additional revenue from UHC could be offset by the reduction in employees at Wendy’s headquarters. The scope of these reductions (in terms of dollars and timing) are unknown to the City. Based on this information, Staff will not be revising the 2017 income tax revenue estimate. The amount originally anticipated for 2017, $84,734,100, will be used as the basis for our revenue when the Capital Improvements Program (CIP) for 2018 – 2022 is presented in the upcoming weeks.

Property Taxes and Service Payments

The normal distribution of property taxes and service payments are made during the first and third quarters of each year. As such, Council can expect an updated analysis on both of these revenue sources during the third quarter financial update.

Hotel/Motel Tax Revenue

The Hotel/Motel Tax Revenue collected through the second quarter 2017 totaled $908,257, which represents a $21,333 or 2.3% decrease over collections through the second quarter 2016.

As a reminder, for hotel stays beginning in January 2016 (remitted to the City in February 2016), City Council increased the funding provided to the Dublin Convention and Visitors Bureau (DCVB) from 25% to 35% of the actual bed tax revenues. Therefore, FY 2017 is the first full year in which the reduced amount to the City is recognized. This needs to be kept in mind when comparing the revenue from year to year. The amount for the DCVB is deposited directly into a separate fund established solely for their portion of the tax revenue.

Similarly, for hotel stays beginning in January 2016, City Council modified the agreement with the Dublin Arts Council (DAC) which provides that organization with 25% of the actual bed tax revenues as opposed to 25% of an estimated amount.

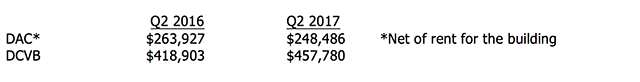

The following reflects the amounts paid to the DCVB and the DAC through the second quarter in 2017 versus 2016:

Other Information

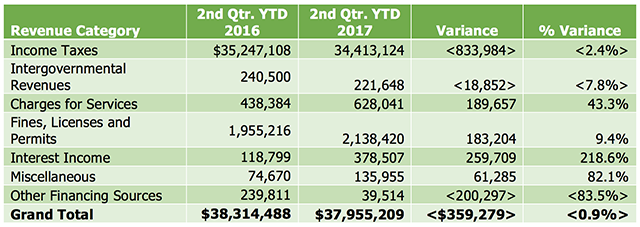

General Fund revenue totaled $37,955,209 through June. This was a decrease of $359,279 or 0.9% over the June YTD 2016 receipts. The total revenue received in the second quarter of 2017 represents 52.9% of the total General Fund revenue budgeted for 2017. A breakdown of the revenues is as follows:

General Fund expenditures through June totaled $63,404,194, which was an increase of 97.6% or $31,321,338. The increase from 2016 to 2017 is largely attributable to advances made to the Capital Construction Fund for capital projects that will ultimately be funded from the proceeds from the sale of bonds. Through the second quarter 2017, $28,573,900 had been advanced from the General Fund with $28,106,700 of that amount going to the Capital Construction Fund. Through the second quarter 2016, only $750,000 had been advanced out of the General Fund, none of which was for the Capital Construction Fund. The advances have been made to pay for the North High Street widening and the construction of the Scioto River pedestrian bridge. These funds will be reimbursed in August when bond proceeds are received.

Excluding advances, June 2017 YTD General Fund expenditures totaled $34,830,294, which was an increase of $3,497,438 or 11% over the June 2016 YTD General Fund expenditures. Of the nearly $3.5 million in additional expenditures, $1.8 million is attributable to an increase in income tax refunds (included in the ‘Other Charges and Expenses’ category). A large refund had been anticipated by staff and was ultimately requested by a former Dublin company at the end of 2016 and paid in 2017. Additionally, $1.7 million more was transferred out of the General Fund to the special revenue funds (Street Maintenance and Repair, Safety, Pool, Recreation and Cemetery Funds) in the first half of 2017 versus 2016. Transfers from the General Fund to these funds are done on a monthly basis and variations from quarter-to-quarter and year-to-year are common. There is no reason to believe at this point in time that the budgeted amounts will be insufficient for the year.

General Fund Balance

The General Fund balance is a critical component to the financial stability of the City and continues to be a key financial indicator used by the rating agencies in evaluating the financial strength of the City. As Council is aware, the City’s policy is to maintain a year-end balance equal to or greater than 50% of the General Fund expenditures, including operating transfers. As of June 30, 2017, the General Fund balance was $31,696,797, or 44.1% of the budgeted 2017 operating expenditures. However, taking into account the $28.1 million advance from the General Fund to the Capital Construction Fund, which will be repaid from bond proceeds in August 2017, the General Fund balance would be $59,803,497, or 83.1% of the budgeted 2017 operating expenditures.