Income Tax Revenues

In the 2017 Operating Budget, Staff projected $84,734,100 in revenue from the local income tax, with 75% or $63,550,575 programmed in the General Fund, and 25% or $21,183,525 programmed in the Capital Improvements Tax Fund. This estimate was based on a 5.8% decrease over the 2016 actual income tax revenue and took into account the loss of revenue anticipated from Nationwide Insurance and JP Morgan Chase.

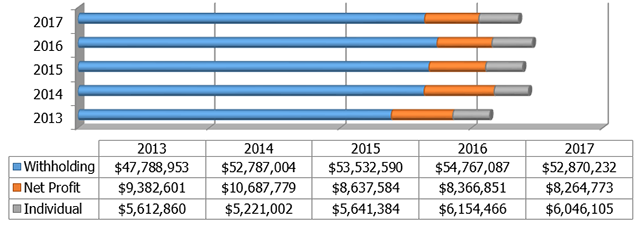

As previously reported to City Council, we recognized this decline in income tax revenue through the 1st and 2nd quarters. The same holds true for the 3rd quarter. Year-to-date revenues through the 3rd quarter 2017 resulted in income tax revenues decreasing 3.0% or $2,107,294. Withholding revenue, the largest component of income tax revenue declined 3.5% while net profits declined 1.2% and revenue from individuals declined 1.8%.

To reiterate, the decline we are currently experiencing is consistent with what we anticipated when projecting our 2017 income tax revenue. The positive news is that our receipts are still ahead of budget by nearly 3.1% or $2 million. We monitor income tax revenues on a daily basis and should there be any activity that causes us concern, we will notify City Council.

The graph below depicts the City’s third quarter income tax revenue each year from 2013 through 2017.

Property Taxes and Service Payments

Property tax revenue in 2017 increased 2.3% or $79,196 over 2016. The total amount collected was $3,580,813 which was distributed between the Capital Improvements, Parkland Acquisition and Safety Funds.

Revenues generated from service payments, or payments in lieu of taxes, on properties within the Tax Increment Financing (TIF) areas increased 25.2% over 2016. Total collections for 2017 were $9,195,281.

Hotel/Motel Tax Revenue

The Hotel/Motel Tax Revenue collected through the third quarter 2017 totaled $1,505,071, which represents a $34,660 or 2.3% decrease over collections through the third quarter 2016.

As a reminder, for hotel stays beginning in January 2016 (remitted to the City in February 2016), City Council increased the funding provided to the Dublin Convention and Visitors Bureau (DCVB) from 25% to 35% of the actual bed tax revenues. Therefore, FY 2017 is the first full year in which the reduced amount to the City is recognized. This needs to be kept in mind when comparing the revenue from year to year. The amount for the DCVB is deposited directly into a separate fund established solely for their portion of the tax revenue.

Similarly, for hotel stays beginning in January 2016, City Council modified the agreement with the Dublin Arts Council (DAC) which provides that organization with 25% of the actual bed tax revenues as opposed to 25% of an estimated amount.

The following reflects the amounts paid to the DCVB and the DAC through the third quarter in 2017 versus 2016:

Other Information

Excluding the repayment of advances, General Fund revenue totaled $56,002,118 through September. This was a decrease of $566,813 or 1.0% over the September YTD 2016 receipts. The reason for the decrease in revenue is attributable to decrease in income tax revenue, which declined 3% through the third quarter of 2017 versus 2016. Growth in receipts in other areas was realized but not enough to entirely overcome the decline in income tax revenue. A breakdown of the revenues is as follows:

Excluding advances, September 2017 YTD General Fund expenditures totaled $57,018,260, which was an increase of $7,291,296 or 15% over the September 2016 YTD General Fund expenditures. The following explains key highlights of the $7.3 million variance.

- Transfers – $5.6 million is attributable to transfers to other funds. Transfers occur on a monthly basis from the General Fund to specific special revenue funds (Street Maintenance & Repair, Recreation, Pool, Safety and Cemetery) when the revenues received within those funds are not sufficient to cover the expenditures. These budgeted transfers vary from month-to-month. There is no reason to believe at this point in time that the budgeted amounts will be insufficient for the year.

- Additionally, for the first time in 2017, pursuant to the City’s adopted General Fund Balance Police (Ordinance 32-16), approximately $1.7 million of the General Fund Balance was transferred to the Capital Improvement Tax Fund (based on the 2016 ending General Fund Balance).

- Contractual Services – Planning services increased $209,000. Much of the increase is attributable to multiple-phase planning studies that were executed in 2016 and continued into 2017, as well as new assignments. These include the Dublin Corporate Area Plan and code update, West Innovation District Plan and code update, Bridge Street District code update, Mobility Study, Historic and Cultural Resources Inventory, Downtown Dublin Parking Management Study and the West Bridge Street Framework Plan. Additionally, Insurance and Bonding increased nearly $440,000 due to a timing difference of when we paid our CORMA premiums in 2016 (in October) versus 2017 (in September).

- Other Charges & Expenditures – The increase in this category is attributable to a $1.7 million increase in income tax refunds. Through September 2016, $2.47 million in refunds had been issued; through September 2017, $4.18 million in refunds had been issued.

General Fund Balance

The General Fund balance is a critical component to the financial stability of the City and continues to be a key financial indicator used by the rating agencies in evaluating the financial strength of the City. As Council is aware, the City’s policy is to maintain a year-end balance equal to or greater than 50% of the General Fund expenditures, including operating transfers. As of September 30, 2017, the General Fund balance was $55,471,898, or 77.1% of the budgeted 2017 operating expenditures.