Summary

- Total General Fund expenditures exceeded total General Fund revenue by $2,912,800; resulting in a decrease of the General Fund balance between December 31, 2017 to December 31, 2018 in the same amount.

- Excluding the three land acquisitions funded by the General Fund during 2018, along with the transfer out of the General Fund to the Capital Improvement Tax Fund (pursuant to the General Fund Balance Policy), General Fund expenditures were $86,579,494. This amount was $7,918,794 less than the General Fund revenue of $94,498,288. As such, it can be concluded that the City did not run a structural deficit during 2018 as a result of operating expenditures.

- 4% of the General Fund budget was actually spent.

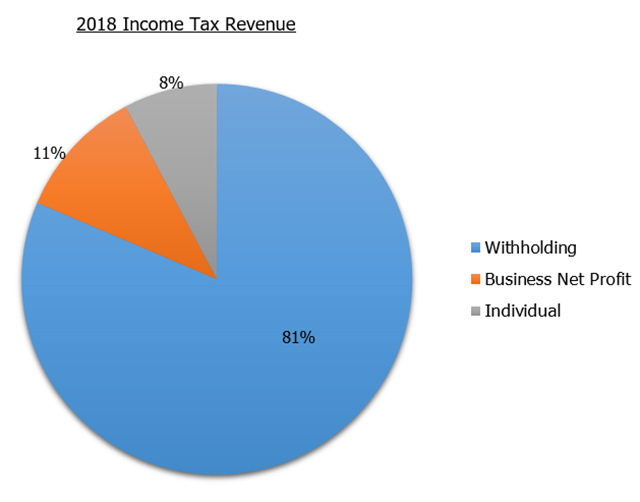

Income Tax Revenues

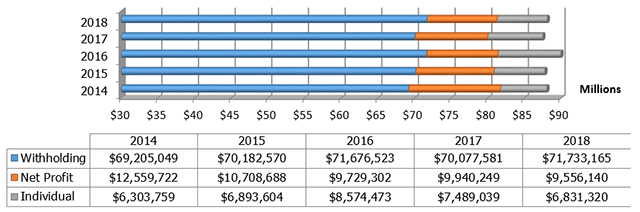

In the 2018 Operating Budget, Staff projected $86,000,000 in revenue from the local income tax, with 75% or $64,500,000 programmed in the General Fund, and 25% or $21,500,000 programmed in the Capital Improvements Tax Fund. Maintaining our conservative approach to estimating revenue, this estimate was based on an assumption of a 1.7% decrease over the 2017 actual income tax revenues. However, our actual income tax revenue for 2018 exceeded projections by 2.47% or $2,120,626. Compared to 2017 income tax revenue, our 2018 collections increased 0.70%, or $613,758.

The City’s largest source of income tax revenue – withholding taxes derived from those individuals working in Dublin – increased 2.36% over 2017. However, revenues from business net profits and individuals declined 3.86% and 8.78%, respectively.

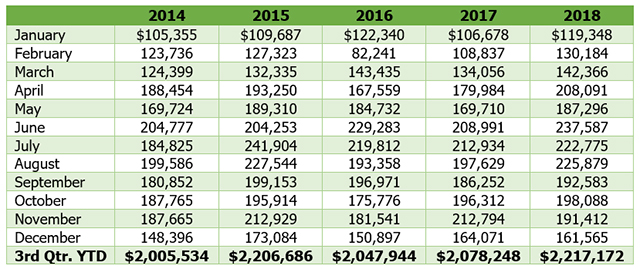

The graph below depicts the City’s income tax revenue through the third quarter of each year from 2014 through 2018.

As a reminder, for hotel stays beginning in January 2016, City Council increased the funding provided to the Dublin Convention and Visitors Bureau (DCVB) from 25% to 35% of the actual bed tax revenues. This will need to be kept in mind when comparing the revenue from year to year. The amount for the DCVB is deposited directly into a separate fund established solely for their portion of the tax revenue. In 2018, the hotel/motel tax revenue dedicated to the DCVB was $1,193,862, an increase of $74,805, or 6.68% over 2017.

Similarly, for hotel stays beginning in January 2016, City Council modified the agreement with the Dublin Arts Council (DAC) which provides that organization with 25% of the actual bed tax revenues as opposed to 25% of an estimated amount. In 2018, the DAC received $696,957 in net revenue (after the deduction for rent and the art in public places program), which was an increase of $59,698, or 9.37% over their payments in 2017.

General Fund

General Fund revenue totaled $94,498,288 in 2018. This was a decrease of $10,131,144 or 9.68% over 2017. However, this amount is exacerbated by the revenue from the repayment of an Advance to the General Fund from bond proceeds received in 2017. Excluding the repayment of Advances, the total General Fund revenue totaled $73,476,404, an increase of $623,455 or 0.86% over 2017. The total revenue received in 2018 (excluding Advances) represents an increase of 5.73%, or $3,984,109 over the total General Fund revised budget for 2018, which took into account a projected $322,500 additional in income tax revenues. A breakdown of the revenues is as follows:

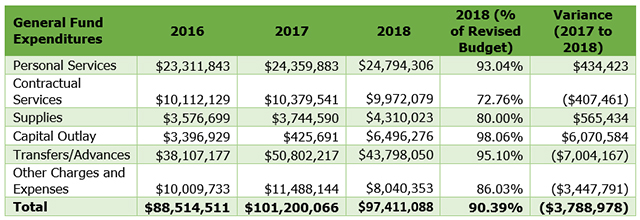

General Fund expenditures in 2018 totaled $97,411,088, which was a decrease of 3.74% or $3,788,978 over 2017. However, similar to General Fund revenue, the expenditures in both 2017 and 2018 were influenced by temporary advances from the General Fund to the Capital Construction Fund in order to begin construction projects that would ultimately be paid from this issuance of bonds (reflecting in the General Fund revenue for each of the years). Excluding Advances, the total General Fund expenditures totaled $76,806,088 an increase of $6,974,954, or 9.99% over 2017.

The primary driver of the increase in expenditures between 2017 and 2018 is related to capital investment. During 2018, the City purchased three properties using the General Fund:

- 84 acres on Eiterman Road at a cost of $4,261,294 (Young Property)

- 215 acres at the corner of Riverside Drive and Emerald Parkway at a cost of $632,250 (Thomas Property)

- 576 acres (which included a building) at 5555 Perimeter Drive at a cost of $4,000,000 (Delta Building) (actual cost of $4,015,497 but $4,000,000 was transferred from the General Fund)

The total cost of these three properties (to the General Fund) was $8,893,544.

In looking strictly at operating expenditures (personal services, contractual services , supplies, other charges and expenses, and transfers to other funds (excluding the transfer to the Capital Improvement Tax Fund completed in January based on our prior year-ending General Fund Balance per the policy), expenditures in 2018 totaled $68,371,763. This was an increase over 2017 in the amount of $714,013, or 1.06%.

In total, 90.39% of the revised General Fund budget (original budget plus carryover encumbrances plus any supplemental appropriations) was actual spent during 2018.

General Fund Balance

The General Fund balance is a critical component to the financial stability of the City and continues to be a key financial indicator used by the rating agencies in evaluating the financial strength of the City. As Council is aware, the City’s policy is to maintain a year-end balance equal to or greater than 50% of the General Fund expenditures, including operating transfers. At year-end, the General Fund balance was $57,212,737, or 74% of the actual 2018 operating expenditures (including supplemental appropriations).