Presentation Purpose/Desired Outcomes

An understanding of the following:

- The various types of debt issued by municipalities in Ohio and the limitations that exist

- The City’s current debt profile

- City’s current Debt Policy as approved by City Council through Ordinance No. 31-16 (September 12, 2016)

- The factors analyzed by Moody’s Investor Services as part of the rating process and the estimated impact of future financings on the City’s rating

- Mechanisms built into our policies/practices that help mitigate against declines in revenue

- Dedicated revenue stream to retire debt service

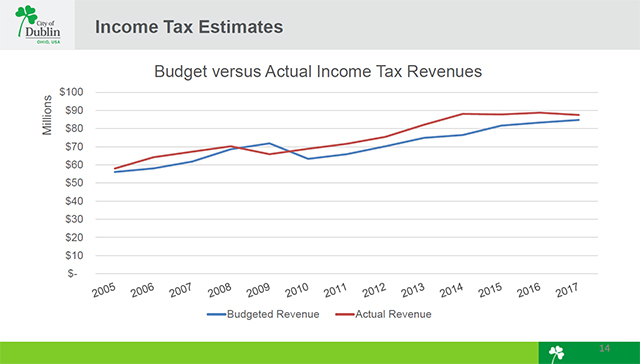

- Conservative revenue , realistic expenditure estimates

- Limit amount available to spend on debt service to 90% of estimated revenue

- Significant cash balances

- Additional coverage for debt supported by TIF revenues (subject to changes in property valuations)

- 5-year CIP that is updated annually

- Affirmation of the City’s existing Debt Policy

Download: Debt Presentation – April, 23 2018