Income Tax Revenues

In the 2018 Operating Budget, Staff projected $86,000,000 in revenue from the local income tax, with 75% or $64,500,000 programmed in the General Fund, and 25% or $21,500,000 programmed in the Capital Improvements Tax Fund. Maintaining our conservative approach to estimating revenue, this estimate was based on an assumption of a 0.4% increase over the 2017 revised revenue estimate, determined when the 2018 Operating Budget was approved. However, our actual income tax revenue for 2017 exceeded the revised estimate by 2.2%. Compared to 2016 income tax revenue, our 2017 collections decreased 2.75%. Ultimately, the 2018 local income tax revenue projection is 1.72% less than actual 2017 receipts.

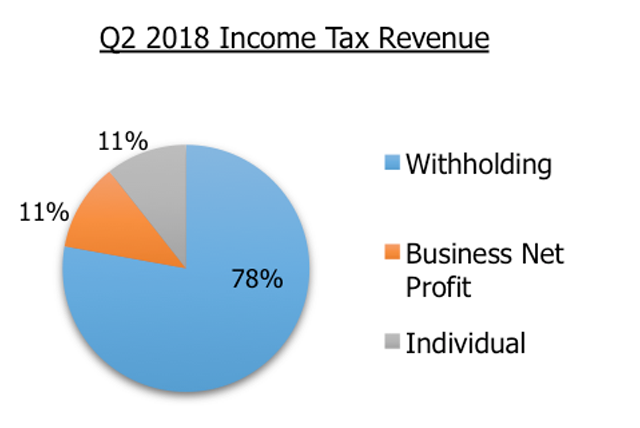

As previously reported, the first quarter closed with revenues decreasing 4.8% over the first quarter 2017. However, income tax receipts rebounded in the second quarter, reflecting a year-to-date decrease over 2017 of .52%. The largest source of the City’s income tax revenue, withholding taxes derived from those individuals working in Dublin, increased 2.22% while business net profits decreased 14.01% and individual returns decreased 3.16%. The total income tax revenue collected through the end of the quarter was $45,644,444.

Actual income tax receipts reflect a nearly $550,000, or 1.22%, increase over the 2018 budgeted amount.

The graph below depicts the City’s income tax revenue through the second quarter of each year from 2014 through 2018.

Property Taxes and Service Payments

The normal distribution of property taxes and service payments are made during the first and third quarters of each year. As such, Council can expect an updated analysis on both of these revenue sources during the third quarter financial update.

Other Information

Important Note: Comparison of March YTD 2017 financial data against March YTD 2016 data may result in inaccurate conclusions. The Department of Finance implemented a new financial system March 1, 2016. The implementation required a ‘black-out’ period at the end of February/early March in which no financial transactions took place, other than payroll. While receipts were deposited to the bank on a daily basis, the entering of receipts and the recording of expenditures in the financial system were delayed. A more accurate comparison should be drawn based on the second quarter information.

Hotel/Motel Tax Revenue

The Hotel/Motel Tax Revenue collected through the second quarter 2018 totaled $1,042,872, which represents a $116,616 or 12.84% increase over collections through the second quarter 2017.

As a reminder, for hotel stays beginning in January 2016, City Council increased the funding provided to the Dublin Convention and Visitors Bureau (DCVB) from 25% to 35% of the actual bed tax revenues. This will need to be kept in mind when comparing the revenue from year to year. The amount for the DCVB is deposited directly into a separate fund established solely for their portion of the tax revenue. Through June 2018, the hotel/motel tax revenue which is dedicated to the DCVB was $551,854, an increase of $62,793, or 12.84% over the second quarter 2017.

Similarly, for hotel stays beginning in January 2016, City Council modified the agreement with the Dublin Arts Council (DAC) which provides that organization with 25% of the actual bed tax revenues as opposed to 25% of an estimated amount. Through June 2018, the DAC had received $286,406 in net revenue (after the deduction for rent and the art in public places program), which was an increase of $37,921 over their payment through the second quarter of 2017.

General Fund revenue totaled $37,518,850 through June. This was a decrease of $436,359 or 1.15% over the June YTD 2017 receipts. The total revenue received in the first quarter of 2018 represents 50.00% of the total General Fund revenue budgeted for 2018. A breakdown of the revenues is as follows:

While income tax revenue is usually the most influential on the General Fund’s overall revenue position, a decrease in revenue from fines, licenses and permits contributed to the overall decrease in revenue of the General Fund. Notable variances between the revenue received in the 2nd quarter of 2018 versus 2017 are as follows:

Intergovernmental Revenues – The primary source of this revenue is local government funding, which is based on the general revenues from the State of Ohio.

Charges for Services – Decrease of 3.63% is attributable to the timing of invoicing for fuel and subsequently receiving the revenue.

Fines, Licenses and Permits – Much of the revenue generated in this category is a function of development activity throughout the City. The following is a comparison between 2017 and 2018 receipt in this category:

General Fund expenditures through June totaled $63,421,394, which was a decrease of 10.1% or $6,376,783 over the second quarter YTD of 2017. The level of General Fund expenditures through the second quarter of 2018 represents 56.13% of the total amount budgeted for 2018 (including carryover encumbrances).

As reflected in the chart above, the largest expenditure in the General Fund is related to Transfers and Advances. The General Fund subsidizes a number of special revenue funds (Street Maintenance & Repair, Cemetery, Recreation, Safety, and Pool Funds) as the revenue generated in these funds is insufficient to cover the expenditures. These subsidies, completed usually on a monthly basis, are reported as Transfers as there is no intention for the amount to be repaid to the General Fund. Other transfers that occur include the annual transfer to the Capital Improvement Tax Fund pursuant to the City’s General Fund Balance Policy as well as transfers for capital projects. The 2018 transfers include a $4 million transfer for the purchase of the property located at 5555 Perimeter Drive and approximately $1.9 million pursuant to the City’s General Fund Balance Policy (based on the year-end fund balance) (Ordinance No. 02-18).

Advances reflect the amounts temporarily moved from the General Fund to other funds, usually the Capital Construction Fund, to advance fund projects that will ultimately be paid using the proceeds from the sale of bonds or TIF revenues. In 2017, the General Fund had advance funded the cost of the North High Street widening and the Scioto River pedestrian bridge. In 2018, Council authorized am advance in the amount of $18,000,000, which represented the cost of the GMP contract with Turner Construction Company, Inc. for the Downtown Dublin parking garages and associated roadway improvements and landscaping enhancements south of the Grounds of Remembrance.

Excluding transfers and advances, the general operating expenses of the General Fund decreased $3,155,933 or 11.1% over 2017.

General Fund Balance

The General Fund balance is a critical component to the financial stability of the City and continues to be a key financial indicator used by the rating agencies in evaluating the financial strength of the City. As Council is aware, the City’s policy is to maintain a year-end balance equal to or greater than 50% of the General Fund expenditures, including operating transfers. As of June 30, 2018, the General Fund balance was $40,599,776, or 51.3% of the budgeted 2018 operating expenditures.

As Council is aware, the General Fund advanced money to the Capital Construction Fund in the amount of $18,000,000 for the CML parking garage, roadway system and landscape enhancements (Resolution No. 04-18 approved by City Council January 22, 2018 authorized the construction contract with Turner Construction Company; Ordinance No. 02-18 approved by City Council February 12, 2018 authorized the advance from the General Fund). This advance reduced the General Fund Balance. Had the advance not been done, the General Fund Balance would have been $58,599,776, or 74.0% of the budgeted 2018 operating expenditures. This advance will be repaid once long-term bonds are issued for this project.